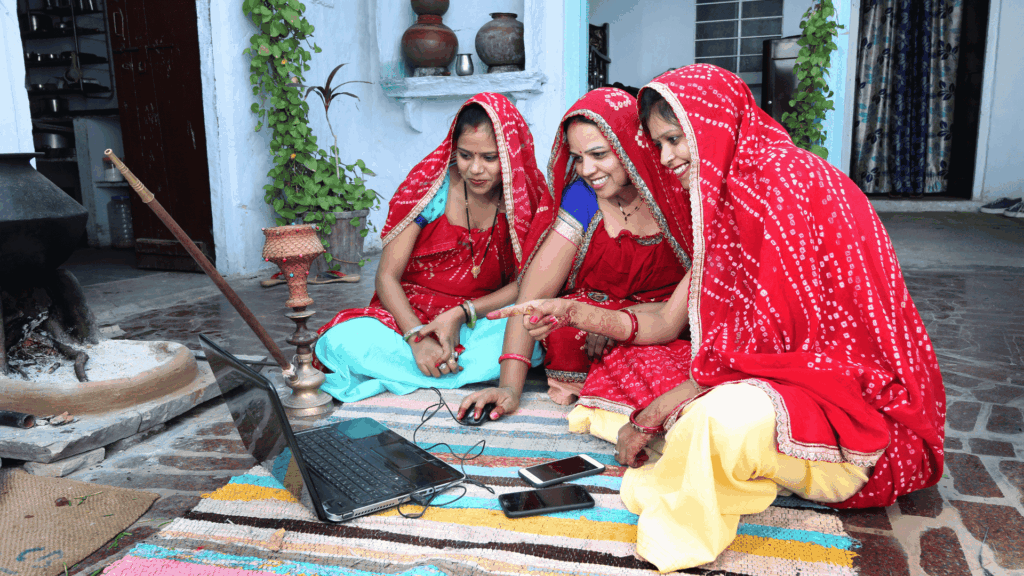

Every woman can become a great entrepreneur. How? All women are born with hard-core management skills, creative thinking, empathy, and solid financial management skills. Women’s entrepreneurship isn’t just a passion. It is all about income growth, employment, and community development. When more women build businesses, the entire economy becomes stronger and more balanced.

Women still face challenges like limited access to credit, low collateral ownership, lack of business networks, and low awareness about formal financial systems. These barriers slow down growth, even when the idea and capability exist.

Government schemes for women entrepreneurs solve many of these problems through financial support, training, subsidies, and structured guidance. They help women launch small businesses, expand existing setups, adopt new skills, and enter sectors that were previously difficult to access. These schemes play a major role in promoting women’s empowerment in India by creating a clear path from learning to earning.

Government Schemes for Women on Funding Support

Lack of capital or financial help is the biggest reason why millions of women do not attempt businesses even after having all the qualities. These government schemes for women make formal credit accessible, simple, and affordable for women.

1. Mudra Yojana for Women

Mudra Yojana offers collateral-free loans through banks and microfinance institutions. Wait.. what’s Collateral-free loans? Collateral-free loans do not require you to pledge property, gold, or any asset to get funding. For example, a woman running a home bakery can take a ₹1 lakh Mudra loan without giving her house papers or jewellery as security.

Mudra Yojana works well for small businesses like salons, boutiques, food stalls, tiffin services, stitching units, small shops, and home-based enterprises.

Loans are divided into three slabs. Shishu covers up to ₹50,000. Kishor covers ₹50,000 to ₹5 lakh. Tarun covers ₹5 lakh to ₹10 lakh. Most first-time women entrepreneurs start under Shishu or Kishor. Some banks offer a small interest concession to women borrowers, making repayment easier.

The loan supports equipment purchase, stock, interiors, raw material, marketing, and working capital. Women only need basic documents and a simple business plan to apply. Mudra Yojana is one of the most widely used government schemes for women entrepreneurs because it removes the biggest hurdle: collateral.

According to a source, more than 65% beneficiaries of this scheme are women.

Image Source: Mudra Yojana official website.

2. Stand-Up India Scheme

Stand-Up India provides loans between ₹10 lakh and ₹1 crore. It supports women, SC, and ST entrepreneurs who want to set up greenfield enterprises in manufacturing, services, trading, or agri-allied sectors.

Each bank branch must support at least one woman or SC/ST borrower under this scheme. The loan is a mix of term loan and working capital. Collateral may be required, but credit guarantee support is available, which reduces the risk for banks.

This scheme helps women who have bigger ideas but need strong financial backing. It supports new units, professional service setups, small manufacturing plants, and other growth-oriented businesses. It is one of the most important government schemes for female entrepreneurs in India because it helps women scale, not just start.

3. Stree Shakti Yojana

Stree Shakti Yojana is a credit-linked scheme designed to support women who want to start or expand small businesses. The scheme rewards women who have completed certified Entrepreneurship Development Programs. Banks give easier loan access, reduced interest rates, and relaxed margin requirements to encourage more women to enter formal business.

The scheme targets women who run micro units like tailoring shops, homemade food businesses, beauty services, handicrafts, trading, retail, and other small enterprises. If a woman holds at least 50% ownership in the business, she qualifies for Stree Shakti benefits. The bank evaluates the project plan and offers financial support based on viability and repayment capacity.

The scheme also improves confidence by linking women to training, credit, and basic financial literacy. It reduces the pressure of high interest rates and helps women invest in equipment, raw materials, and working capital. Stree Shakti stands out in the list of government schemes for women entrepreneurs because it is simple to apply, practical, and designed for real micro businesses that want steady income growth.

4. Mahila Udyam Nidhi Scheme

Want to start a manufacturing unit and get in the group of India’s best producers? Mahila Udyam Nidhi Scheme is for you. It provides soft loans for women who want to set up or expand small-scale industrial units. The loans usually come through SIDBI and select banks. The repayment terms are flexible, and the interest rates are lower than those of regular business loans.

Women can use this scheme for machinery purchase, unit expansion, modernisation, or new product line development. It supports long-term growth by funding assets that improve production capacity.

This scheme benefits women who want to move from home-based operations to a structured small unit. It is an essential part of government schemes for women entrepreneurs because it encourages asset creation, innovation, and long-term stability.

Schemes for Skill Development and Capacity Building

Skill development is the foundation of long-term entrepreneurship. Many women have ideas but need training, confidence, and practical exposure. These government schemes for women entrepreneurs focus on building professional skills, technical knowledge, and employability.

1. STEP: Support for Training and Employment Program for Women

STEP provides training in sectors where women can build a stable income. These sectors include agriculture, horticulture, food processing, handloom, computer services, hospitality, and more. The scheme includes training, mentorship, and employment support.

The objective is simple. Equip women with skills that match real industry demand. The training helps women start small businesses, join production units, or build service-based careers. It improves earning potential and reduces dependence on low-paying informal work. STEP is an important part of government schemes for women because it prepares women to earn with confidence and competence.

2. PM Kaushal Vikas Yojana (Women Focused Modules)

PMKVY offers free skill training across India. Women can choose from courses like digital skills, retail, beauty therapy, baking, sewing, healthcare assistance, and more. Many training centres offer women-focused batches in safe learning environments.

The scheme also covers certification. This builds credibility and helps women secure jobs or start formal businesses. Women can apply these skills to launch services like beauty salons, daycare centres, home bakeries, or digital service agencies. PMKVY is one of the most accessible government schemes for women’s empowerment in India because it removes the cost barrier to learning.

Schemes for Technology, Innovation, and Startup Growth

These schemes target women who want to build modern businesses, work with technology, and enter high-growth sectors. They support innovation, digital adoption, and structured entrepreneurship.

1. TREAD: Trade Related Entrepreneurship Assistance and Development

TREAD helps women learn skills and get money to start a business. The government gives money to NGOs. These NGOs train women and help them get loans from banks. Women do not have to deal directly with banks at the start.

This scheme is useful for women who need guidance along with money. It helps women start small businesses, work in groups, or sell their products in organised markets.

2. Udyam Registration Benefits for Women

When women register their business under Udyam, they enter the MSME ecosystem. This unlocks multiple benefits like priority lending, credit guarantee support, subsidies, lower interest rates, and easier access to government tenders.

Udyam registration also improves business credibility. It helps women enter formal supply chains and collaborate with larger companies. Women who want to grow beyond local markets prefer this route because it creates long-term access to finance and government support.

3. Startup Support for Women in India

The government helps women who want to start new businesses through programs like Startup India, Atal Innovation Mission, and SIDBI. These programs are for women who have a business idea but do not know how to turn it into a proper business.

Women get help step by step. First, experts listen to the idea and tell whether it can work in the market. Then they guide women on how to improve the idea, make a sample product, and understand customers. Women also get training on pricing, marketing, and running the business.

Many women feel scared to start because they do not know the paperwork or rules. These programs give mentors who explain things in simple ways. Some women also get small funding or grants through approved centres, so they can start without borrowing from family or moneylenders.

This support is helpful for women who want to start businesses in areas like food products, education services, health services, small factories, online work, or technology-based services. The main goal is to help women move from an idea to a real business that can grow step by step.

Schemes for Social Empowerment Linked With Entrepreneurship

These schemes focus on community-based economic empowerment. They support women in rural and semi-urban regions by connecting them to markets, training, and income activities.

1. National Rural Livelihood Mission (NRLM)

NRLM empowers women through Self Help Groups. It provides training, microcredit, and market linkage. Women form groups, start small businesses, run production activities, or manage service-based units.

The scheme strengthens financial independence and community leadership. Women learn budgeting, saving, credit management, and group entrepreneurship. Many rural businesses in food processing, stitching, papad making, soap production, and handicrafts grow under NRLM.

This is one of the best government schemes for female entrepreneurs in India, as it has mobilized over 10 crore rural women into more than 90 lakh SHGs by late 2025.

2. Government e-Marketplace (GeM) Portal

GeM is a government online buying platform. Government offices, schools, hospitals, and public departments buy products and services from this portal. Women can sell their products directly to the government through GeM.

A woman can register her business on GeM and list products like uniforms, food items, handicrafts, furniture, stationery, cleaning services, catering, stitching work, and many other items. There is no need to meet officers or middlemen. Orders come online.

The government gives special support to women sellers on GeM. Women get preference in many government purchases. Payments are safe and come directly to the bank account. This helps women earn regularly and avoid cheating or delayed payments.

GeM is useful for women who already make products but do not know how to reach big buyers. Once registered, even a small business can sell to large government departments across India. This portal helps women turn small work into a steady income.

3. Annapoorna Scheme and Stree Shakti Package

These bank-linked schemes provide credit, margin benefits, and financial support to women who run small units. Annapoorna helps women in the food sector, like mess, tiffin services, small eateries, and food production.

Stree Shakti Package focuses on women who have already attended Entrepreneurship Development Programs. It offers interest concessions and easier loan processing. Both schemes strengthen women’s entrepreneurship by making credit flexible, simple, and accessible.

How to Apply and Eligibility Criteria for Government Schemes for Women

Most government schemes for women entrepreneurs follow a simple application flow. Women only need basic documents like Aadhaar, PAN, address proof, bank account details, and a clear idea or project plan. Different schemes have different eligibility rules, but the core process remains easy to follow.

Mudra Yojana for Women

• Eligibility: Women running small businesses or planning to start micro units.

• Support: ₹50,000 to ₹10 lakh without collateral.

• Apply Through: Any bank, NBFC, or microfinance institution.

• Requirements: Basic KYC, simple business plan, bank statement.

Stand-Up India Scheme

• Eligibility: Women above 18 years planning greenfield enterprises.

• Support: ₹10 lakh to ₹1 crore.

• Apply Through: Bank branches or the Stand-Up portal.

• Requirements: Project report, business constitution, collateral or guarantee cover.

Stree Shakti Scheme

• Eligibility: As defined by the participating bank for women entrepreneurs or women SHGs.

• Support: Interest concessions and easier loan terms on eligible business loans.

• Apply Through: Participating public sector banks offering Stree Shakti packages.

• Requirements: KYC documents, business proposal, and bank-specific criteria.

Mahila Udyam Nidhi Scheme

• Eligibility: Women running or planning small-scale units.

• Support: Soft loans with flexible repayment.

• Apply Through: SIDBI or partner banks.

• Requirements: Project plan, machinery list, KYC.

STEP Scheme

• Eligibility: Women above 16 years.

• Support: Free training and employment guidance.

• Apply Through: Training institutes partnered with STEP.

• Requirements: Basic ID proof.

PMKVY (Women Modules)

• Eligibility: Women seeking job-oriented training.

• Support: Free courses and certification.

• Apply Through: PMKVY training centres.

• Requirements: Aadhaar, address proof.

TREAD Scheme

• Eligibility: Women supported through NGOs.

• Support: Training plus credit.

• Apply Through: Bank-linked NGOs.

• Requirements: Group membership, ID proof.

Udyam Registration

• Eligibility: Any woman-owned business.

• Support: MSME benefits, priority loans, subsidies.

• Apply Through: Udyam Registration portal.

• Requirements: PAN, Aadhaar, basic business details.

GeM Portal (Government e-Marketplace)

• Eligibility: Women-owned businesses, women entrepreneurs, and women-led SHGs with valid business registration.

• Support: Direct access to government buyers, online orders, and secure payments.

• Apply Through: GeM portal.

• Requirements: Aadhaar, PAN, bank details, and product or service details.

Real Examples of Women Who Benefited

Real examples make government schemes for women entrepreneurs easier to understand. These stories show how women use support, loans, and training to transform their business dreams into income.

Example 1: Mudra Yojana

Sarita Devi, a rural homemaker, received a loan of ₹30,000 for dairy farming. Rajani Sharma, on the other hand, received a loan of ₹2,00,000 for her clothing boutique. Neha Singh took a Tarun loan of ₹7,00,000 to start a food processing unit. She makes traditional snacks and gives work to women in her village while keeping local food traditions alive.

Example 2: Stand-Up India

Shyama Devi was once a poor homemaker who struggled to pay daily expenses and her children’s school fees. After training from KVK and RSETI, she learned skills and slowly started working with women in her group.

Today, Shyama is a trained master trainer who teaches women not only in her village but also in other districts of Uttarakhand. She now owns a house and a car. Her husband supports her work. Shyama says she first learned by doing and then helped others. She continues to guide women so they can improve their lives, too. Source.

Example 3: PMKVY

Archana Pawar from Mumbai wanted to be independent and earn on her own. She joined a skill training program under PMKVY, where she learned to drive. This training gave her confidence and a new skill.

After completing the course, she took a Mudra loan to buy a two-wheeler and a car. With these vehicles, she started her own motor driving school. Today, Archana runs her business and earns with pride. Government training and loan support helped her turn her dream into reality. Source.

If you want a clean and simple ‘government schemes for women’s empowerment in India PDF’, you can contact us.

The PDF usually includes:

• List of important schemes

• Eligibility criteria

• Loan limits and benefits

• Skill training options

• Application links

• Required documents

• Step-by-step process

• Contact details of key portals

This helps women take action without confusion. A PDF is easy to share with groups, SHGs, business communities, and women who want to start or scale their enterprise.

Conclusion

Government schemes for women entrepreneurs create real opportunities for women across India. They reduce financial barriers, improve access to skills, and support long-term business growth. When women get the right mix of training, funding, and market access, they build strong and sustainable enterprises.

These schemes support small home-based units as well as ambitious businesses that want to scale across India. When women use these schemes effectively, they gain independence, confidence, and growth.

For more such informative blogs, follow YouthKnows.

This is a well-written and informative article. I appreciate how you highlighted the key government schemes for women and their benefits. It will definitely help readers understand their rights and opportunities.

It’s great to see such effort to spread awareness about government schemes for women.”

Thank you so much, Shubhangi, for your kind words.